What is a Recession? What are US Treasuries? What is the Yield of a Treasury? What is the Yield Curve?

Read more

As we get closer to the new year, many of the world’s top economies, including the U.S., are worried about a recession.

What is a Recession? During a recession, an economy’s overall output usually goes down for at least two consecutive quarters, jobs are lost, and overall demand goes down.

What are US Treasuries?

- In any economy, the safest loans are those given to governments, which will always be around, and typically do not default on their debt.

- Governments need to borrow money because most of the time, taxes don’t bring in enough money to pay for everything they want to do.

- A government bond is an instrument by which the government borrows from the market.

- In India, these bonds are known as G-secs, in the UK as gilts, and in the US as treasuries.

What is the Yield of a Treasury?

- Unlike a bank loan, on which the interest rate varies with time, a government bond comes with a pre-determined “coupon” payment.

- So, the US government could “float” a 10-year bond worth $100 with a $5 coupon payment. This means that if you bought this bond and gave the US government $100, you would get $5 back every year for the next 10 years and the whole $100 back at the end of 10 years. This would mean that the return or yield is 5%.

- But if you sold this bond to another investor for some reason, the yield would change depending on how much you sold it for. If the price goes up, say the bond is sold for $110, the yield will go down because the annual return ($5) stays the same. If the price goes down, the yield will go up.

What is the Yield Curve?

- Governments can borrow money for anywhere from 1 month to 30 years.

- Longer tenures typically have greater yields because one is lending money for a longer period of time.

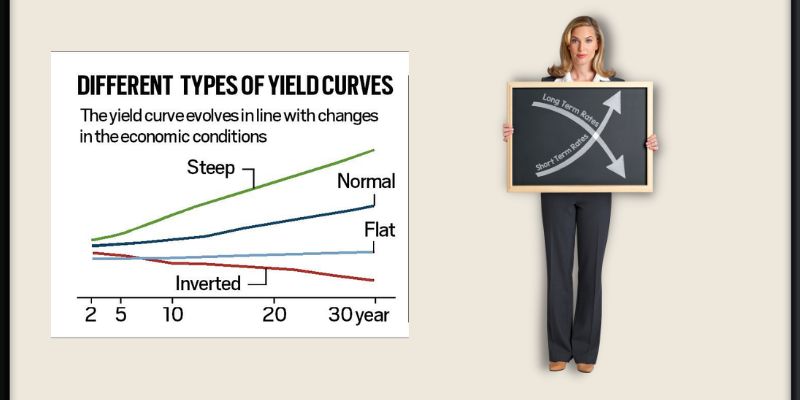

- If the yields for various bond tenures are shown, an upward-sloping curve will result.

- Depending on the amount of money available in the market and the predicted overall economic activity, the curves can be flat or steep. When investors are optimistic about the economy, they move money out of long-term bonds and into riskier assets such as stock markets. As prices of long-term bonds decrease, their yields rise, and the yield curve steepens.

What is Yield Inversion?

- Yield inversion is when the yields on bonds with a shorter term are higher than the yields on bonds with a longer term. If investors think the economy is going to have trouble, they will move their money out of short-term risky assets like stock markets and into long-term bonds. This causes the prices of long-term bonds to increase and their yields to fall. This process first causes the yield curve to flatten, and then it causes the yield curve to turn upside down.

- Yield inversion has been a reliable indication of recession in the US for a long time, and it has been happening for a while now with US treasuries.

Is this all a surprise?

No, not at all. In order to keep inflation from getting too high, the US Federal Reserve has been raising short-term interest rates to slow down overall demand and economic activity. Every time in the past that the Fed tried to bring inflation down by more than two percentage points, the US went into a recession.

So, the more the Fed raises interest rates, the more likely it is that the US economy will go into a recession. The yield inversion shows that this is the case.

We hope it’s just a slowdown and not a full-fledged recession. But it’s important to remember that in many ways, the middle class has already been in a recession for a long time because inflation has raised the prices of everything from food to housing to transportation.

Source: IE